GET-THE-BEST-RATE

PAY OFF your Mortgage in ~7 YEARS!

Get Professional Advanced Mortgage Advice - FREE!

Reduce Interest cost by ~$248,000 on a $600,000, Mortgage.

Master your Mortgage for Financial Freedom!

Working with Home Buyer's and Home Owner's in BC, and across Canada.

Follow My Three Step Plan

To Get The Ultimate Mortgage!

Get started right away

The best place to start is to connect with me directly. My commitment is to listen to your needs, assess your financial situation, provide professional mortgage advice, and

guide you through the mortgage process.

Get clarity

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming.

Let me cut through the noise. I'll outline the best mortgage products available with your needs in mind.

Proceed with confidence

My goal is to make sure you know exactly where you stand at all times. From your initial application through your mortgage renewal, I'm available to answer any questions for as long as you need a mortgage.

I've got you covered.

Your Home Mortgage Interest is

NON-TAX DEDUCTIBLE

Convert your Home Mortgage into a

TAX-DEDUCTIBLE

loan AND pay off your mortgage in record time.

All without straining your current finances.

You don’t have to increase your required payment to ACHIEVE INCREDIBLE RESULTS!

Your path to financial freedom starts today.

As a trusted Canadian Mortgage Broker and Smith Manoeuvre Certified Professional (SMCP), I help homeowners turn mortgage debt into long-term wealth.

I specialize in Smith Manoeuvre strategies, including cash damming and debt swaps, with tax-efficient mortgage planning.

BUY THE BOOK

Why Read The Smith Manoeuvre?

If you have a mortgage in Canada, this book can show you how to turn it into a powerful wealth-building tool. Learn how to make your interest tax-deductible, pay off your mortgage faster, and invest for your future—without spending more or increasing your debt. It's a simple strategy with life-changing potential.

Smith Manoeuvre FAQs

What is the Smith Manoeuvre?

The Smith Manoeuvre is a Canadian financial strategy that gradually converts non-deductible mortgage debt into tax-deductible investment debt. Using a readvanceable mortgage, you borrow available equity to invest in income-producing assets, while continuing to pay down your mortgage. Over time, you reduce non-deductible interest and build an investment portfolio.

Is the Smith Manoeuvre legal in Canada?

Yes, when it’s structured correctly. The Canada Revenue Agency allows interest to be deducted when borrowed funds are used for the purpose of earning investment income. Accurate tracking, documentation, and correct setup are critical. As an SMCP®, I coordinate with your tax professional to ensure the strategy is applied appropriately.

Do I need a readvanceable mortgage to use the Smith Manoeuvre?

Yes. A readvanceable mortgage combines a traditional mortgage with a HELOC. As you make payments, your available credit increases, allowing you to reinvest systematically. Without a readvanceable mortgage, the strategy cannot function as designed.

Who is the Smith Manoeuvre best suited for?

It works best for disciplined homeowners who:

- have a stable income

- plan to own their home long-term

- are comfortable with investing

- pay income tax annually

- want to build wealth more efficiently

If cash flow is tight, risk tolerance is low, or timelines are short, we may explore alternatives or adjust the approach.

Is the Smith Manoeuvre risky?

Like any investment strategy, there is risk. Investment values fluctuate, and interest rates can change. My role is to assess your cash flow, stress-test scenarios, and make sure the structure is conservative, transparent, and aligned with your tolerance and long-term plan.

How long before I see benefits?

Many homeowners notice tax deduction benefits within the first couple of years. The real power compounds over 10 to 20+ years as investments grow and non-deductible mortgage interest shrinks. It’s a long-term strategy, not a quick-win tactic. The results are typically life-changing.

What types of investments are used?

Generally, investments must have the potential to generate income (interest, dividends, rent, etc.). Common choices include professionally managed or self-managed portfolios, dividend-paying funds, or other market-based investments, guided by your investment advisor. Speculative investments typically don’t qualify.

Can I still make extra payments on my mortgage?

Yes! And those extra payments accelerate the strategy. Each payment frees up more HELOC room, which can then be reinvested. Done correctly, your tax deductions increase while your non-deductible balance declines faster.

What if I move or sell my home?

The strategy can continue if your next mortgage is appropriately structured. If you sell, we ensure everything is unwound correctly, interest remains traceable, and tax documentation is clean. Planning prevents missteps.

Is Cash Damming, or Rental Cash Damming, part of the Smith Manoeuvre?

Yes! Five “Accelerators” can be applied to the Smith Manoeuvre. An accelerator will convert your non-tax-deductible mortgage debt to tax-deductible debt faster than simply using the “Plain Jane” strategy. As an SMCP®, I examine your current cash flow to determine which accelerators are available to you and demonstrate how significant the gains will be when applied.

Why work with an SMCP®?

An SMCP® understands:

- correct structure and lending options

- CRA rules and interest traceability

- investment and tax coordination

- ongoing monitoring and documentation

Most mortgages are not automatically set up to support the Smith Manoeuvre. My role is to help ensure yours is.

This content is for educational purposes only. Always consult your tax professional and licensed investment advisor before implementing the Smith Manoeuvre.

Still have a question?

Get started by BOOKING A CALL WITH ME.

I'll let you know exactly where you stand so you can proceed with confidence.

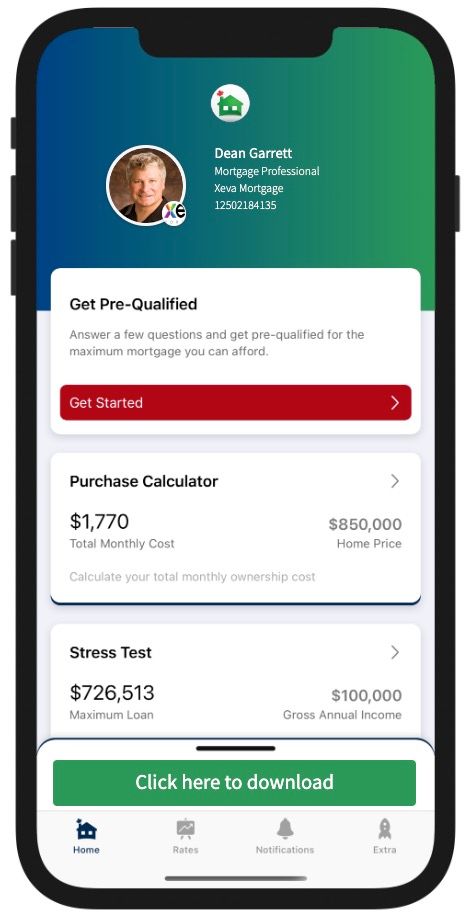

Download my Mortgage Toolbox App

Everything you need,

all in one place

As a trusted mortgage provider, let me help you with these services.

Click through any of the services to learn more

Mortgage articles to keep you informed.

Go ahead and schedule a meeting with me!

Mortgage FAQs for Canadian Homeowners

What’s the difference between using a bank and using a mortgage broker?

Banks offer only their own mortgage products, and they often provide weak preapprovals. As a mortgage broker, I offer you access to multiple lenders, structures, and strategies, including readvanceable mortgages, refinancing options, debt-consolidation tools, and long-term planning support. And accurate preapprovals! My goal isn’t to sell a mortgage; it’s to be your debt advisor.

When should I consider refinancing my mortgage?

Refinancing may make sense when you want to:

- lower total borrowing costs

- roll high-interest debt into lower mortgage rates

- access equity for investing or renovations

- convert to a readvanceable structure

I always calculate penalty costs versus benefits before moving forward.

What is a readvanceable mortgage?

A readvanceable mortgage links a regular mortgage with a HELOC. As the mortgage balance decreases, available credit increases. This structure enables strategies like the Smith Manoeuvre and provides flexible access to home equity. Few homeowners make it through the entire amortization period without needing to access their equity to advance their goals.

Should I choose a fixed or variable rate?

It depends on your:

- risk tolerance

- income stability

- time horizon

- likelihood of moving or refinancing

- overall strategy (including tax planning)

We review multiple scenarios so your rate decision aligns with your plan, not just today’s rate.

Is consolidating debt into my mortgage a good idea?

It can be, if it reduces interest costs, improves cash flow, and prevents future debt buildup. The key is pairing consolidation with an intentional plan so the debt doesn’t reappear. We run numbers before making the decision.

Can my mortgage help me build wealth, not just pay debt?

Yes, when structured intentionally. Using tools like readvanceable mortgages, disciplined investing, and tax-efficient strategies, your mortgage can become part of your wealth plan instead of just an expense. As a mortgage takes such a large part of your fiscal timeline, you can benefit from intentionally refinancing your loan over the repayment period. You can use your mortgage to both buy a home and build out your retirement needs.

How much down payment do I really need?

In Canada:

- 5% minimum on homes under $500,000

- blended structure from $500,000 to $1,000,000, where it is 10% on the amount between $500,000 to $1,000,000.

- 20% required on homes over $1,000,000, up to ~$1,500,000 depending on lender and location

- Over $1,500,000 the down payment becomes 50% of the amount over.

Your situation, credit, and goals determine the best approach, not just the minimum rules.

What costs should I expect when arranging a mortgage?

Typical costs may include appraisal fees, legal fees, title insurance, transfer taxes, and possibly penalties if breaking an existing mortgage. We review everything upfront so there are no surprises, and I supply you with a full comprehensive breakdown of all your costs.

How often should my mortgage be reviewed?

Ideally, once per year, and always at:

- renewal time

- major life changes

- interest rate shifts

- when tax or investment plans evolve

Proactive reviews keep your mortgage aligned with your goals. You can use your Mortgage loan to achieve much more than just home ownership. Buying the home is the first step.

What’s the biggest mistake homeowners make?

Treating the mortgage like a one-time transaction. The most successful homeowners think strategically, using their mortgage as a financial planning tool rather than just a loan to buy a house. The costs and timelines are too high and too long. My role is to help design and manage a long-term plan.

I'm looking forward to hearing your thoughts on the above, and to making my web page the primary driver of new business for me.